Bank of England base rate change

This is the official interest rate set by the Bank of England’s Monetary Policy Committee.

It has decreased the base rate from 4.50% to 4.25%.

If you have a mortgage product that is linked to the Bank of England Base rate, then your monthly payments will change. We will confirm the changes in writing to you shortly.

No, your mortgage Terms and Conditions remain the same.

FAQs

We cater for the needs of a wide variety of businesses and entrepreneurs, including: individuals, limited companies, limited liability partnerships (LLPs), self-invested personal pensions (SIPPs), small self-administered schemes (SSAS) and trusts. Individuals: When lending to individuals, our standard conditions apply and are dependent on the status of the applicant (i.e. employed, self-employed, owner occupier or investor). Note: Loans are available: for applicants acting solely within their trade, business or profession, and when the purpose of loan solely relates to such trade, business or profession Limited companies: For limited company applications, the majority shareholders must be party to the application. They will be required to provide a full personal guarantee. Limited companies registered outside of England or Wales will be considered on a case-by-case basis. Limited liability partnerships: These will be treated much the same as limited companies. Self-invested personal pensions and small self-administered schemes: We’ll need to carry out due diligence on the pension scheme and the commercial tenant. Trusts: A copy of the trust deed will always be required.

There are occasions when we will require a meeting. This tends to be in cases where our loan exposure to the applicant exceeds £3,000,000. These face-to-face meetings happen prior to issuing a Formal Offer.

The ICR is the calculation we use to determine that the loan is affordable on an investment basis and that the market rent determined by the valuer provides adequate cover for the loan repayments. We expect cover to 125%-160% of the interest-only payment, depending on the property type and whether or not we are lending to a limited company. For full details please see the individual product pages.

Strictly speaking, we do not have limits on concentration. However, we may seek to either limit the LTV or load the pay rate to reflect the concentration risk.

Gifted deposits will be considered but only where the gifted deposit is from an immediate family member e.g. parents, siblings and/or grandparents.

Yes, subject to certain restrictions.

InterBay will allow Gold Key Partners to operate as a packager for straight forward Buy to Let business and to submit a fully packaged case for a formal offer.

The London Interbank Offered Rate (LIBOR) was, until 31st December 2021, an indication of the average rates at which banks could obtain unsecured funding, and for many years has been used globally as a key interest rate benchmark across a wide range of financial products, including mortgages.

The aim of LIBOR was to measure the interest rate at which banks could borrow from one another. LIBOR relied on information about markets which is no longer be available from banks. Therefore, LIBOR is no longer considered sustainable and is being phased out.

The methodology for calculating LIBOR changed at the end of 2021. Therefore all mortgage lenders have been working to switch mortgages to an alternative reference rate.

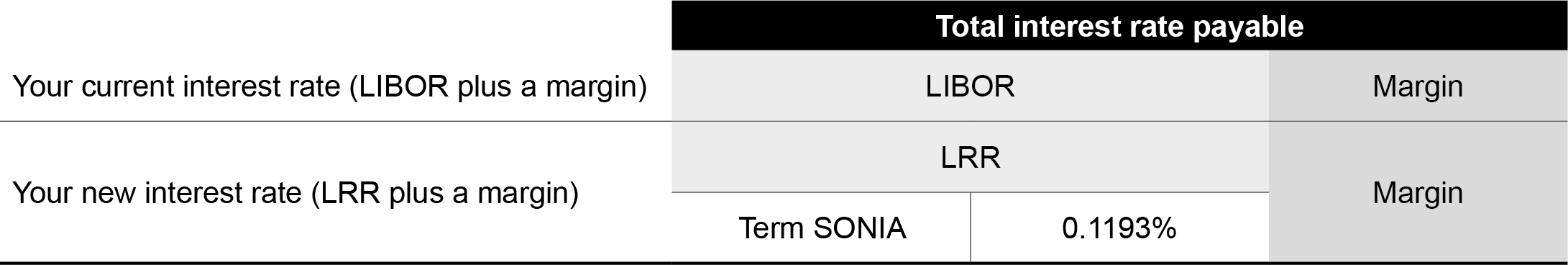

We’re replacing LIBOR with 3-Month Term SONIA (Term SONIA) plus 0.1193%.

We’ve chosen Term SONIA because it’s an interest rate benchmark that’s been developed as one of the alternative reference rates to replace LIBOR in some products.

The adjustment of 0.1193% is needed to reflect the difference in the way LIBOR and Term SONIA work and to ensure the new rate performs in a similar way as LIBOR would’ve done over the term of your mortgage. This adjustment will be fixed at 0.1193% for the remaining term of your mortgage.

We consider this will be a fair replacement rate and it is the revised methodology that is being used to calculate LIBOR for a limited period after 31 December 2021.

SONIA stands for the Sterling Overnight Index Average. Term SONIA is publicly accessible and is calculated by an independent body, in this case ICE Benchmark Administration Limited.

You can find out more about how Term SONIA is calculated here: https://www.theice.com/iba/risk-free-rates#sonia.

The FCA has made it clear that LIBOR transition should not be used to move customers with LIBOR linked mortgages to replacement rates that are expected to be higher than LIBOR would’ve been, or otherwise introduce inferior terms.

In addition, the FCA doesn’t expect mortgage lenders to be worse off as a result of replacing LIBOR with an alternative rate.

Because of the difference in the way LIBOR and Term SONIA work, to ensure the fair conversion of existing contracts, a small adjustment is needed to account for this difference. Further information about this adjustment (often referred to as a credit adjustment spread) is available on the Bank of England website:

This reflects the revised methodology that is being used to calculate LIBOR for a limited period after 31 December 2021.

The adjustment we’ll apply to your mortgage is 0.1193%

We consider this fair because it reflects the average difference between 3-Month LIBOR and 3-Month Term SONIA over an historical five year period, has been calculated using an approach which has consensus and acceptance across the financial services industry and is the same adjustment which is being used in the calculation of LIBOR for a limited period after 31 December 2021.

If you want to know more about how this adjustment is calculated, please see the explanatory documents on the Bank of England website:

LRR replaced LIBOR as the basis for calculating the interest rate you pay on your mortgage with effect from 1 January 2022. Following the switch, the interest rate charged on your mortgage is LRR (which is 3-Month Term SONIA plus the adjustment of 0.1193%) plus the existing margin stated in your mortgage agreement.

A diagram showing how your interest rate will be calculated is below:

This is subject to any minimum interest rate (the interest rate ‘floor’), and/or any minimum rate for LIBOR and LRR as set out in your mortgage agreement.

LRR will be rounded up to two decimal places.

If you don’t want to accept LRR replacing LIBOR in the calculation of the interest rate on your mortgage you can repay your mortgage in full at any time or remortgage to another provider.

If you’re considering one of these options, please contact us. We can provide you with a redemption statement that will explain the amount that needs to be repaid and any early repayment charges that may apply.

You may wish to get financial advice when deciding what is the best option for you.

The Money Helper website https://www.moneyhelper.org.uk/en provides free and impartial financial guidance that’s backed by the government, and has details of independent financial advisors should you wish to discuss the replacement of LIBOR and how this impacts you. Alternatively, you can call them on 0800 138 7777 between 8am and 6pm, Monday to Friday.

The FCA has acknowledged that despite lenders’ efforts to replace LIBOR in mortgage contracts, there may be some cases where this won’t have happened before the end of 2021.

In 2021 the FCA consulted on a temporary solution for the continued use of LIBOR based on a changed methodology – you may see this referred to as ‘Synthetic LIBOR’. It wasn’t clear until late in 2021 whether it would be possible to use Synthetic LIBOR to calculate the interest rate on your mortgage.

The FCA have also made it clear that the use of Synthetic LIBOR is a time-limited solution, reviewed annually, so any switch to Synthetic LIBOR would only be temporary, so it’s likely your mortgage would still have needed to switch to an alternative rate in the future.

So we made this change with effect from 1 January 2022 to give you certainty about how the interest rate on your mortgage will be calculated beyond the end of 2021.

We’ve replaced LIBOR with a reference rate that is calculated in the same way as Synthetic LIBOR is being calculated from 1st January 2022, so you shouldn’t be disadvantaged by this change.

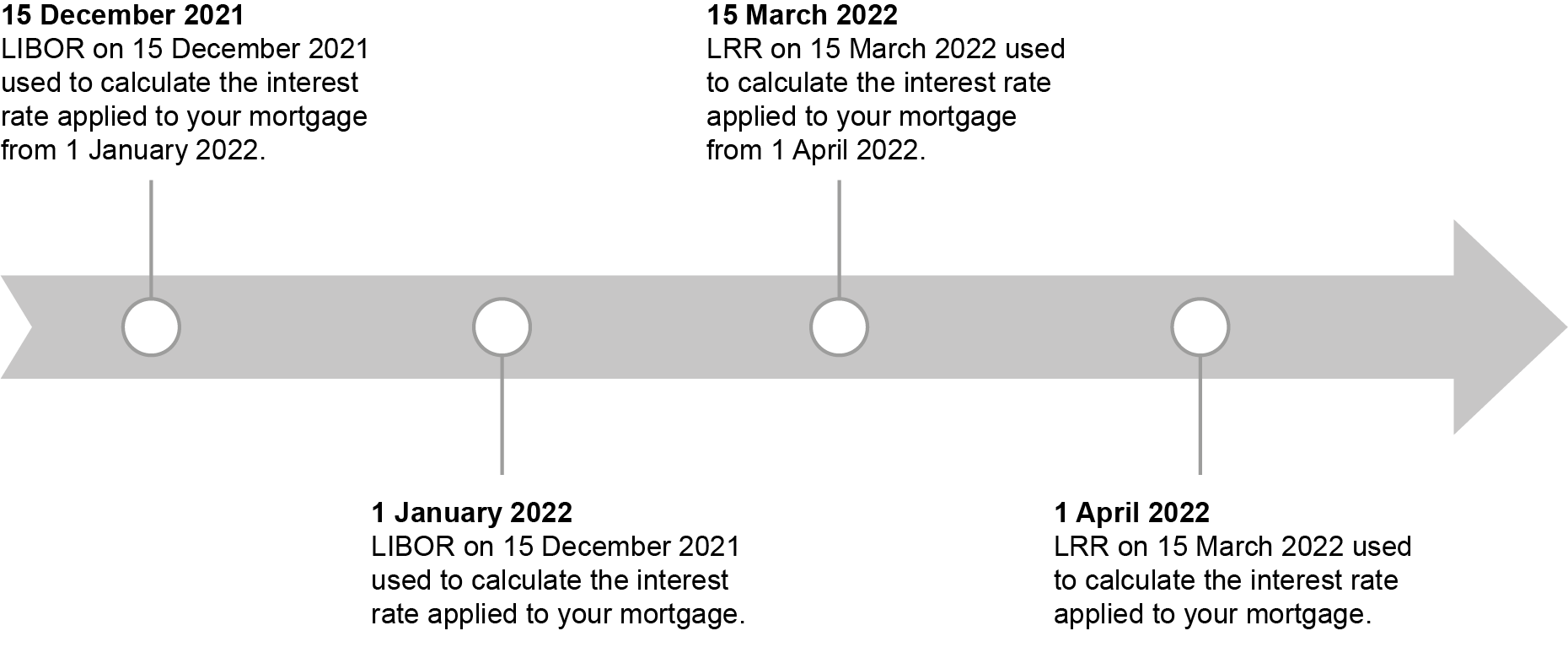

We’ve not made any other changes to how and when we re-calculate the interest rate you pay, we’ll simply use LRR instead of LIBOR to make that calculation.

For example, if your mortgage agreement provides that the interest rate you pay will be a margin above LIBOR and recalculated quarterly based on the LIBOR rate on that day, we’ll continue to recalculate the interest rate you pay on those scheduled dates, but by adding the margin to the LRR on that day rather than the LIBOR rate on that day.

Your terms and conditions will explain how and when we recalculate the interest rate you pay and whether there’s any minimum interest rate (the interest rate ‘floor’), and/or any minimum rate for LIBOR which will apply to LRR.

The FCA has made it clear that LIBOR transition shouldn’t be used to move customers with LIBOR linked mortgages to replacement rates that are expected to be higher than what LIBOR would’ve been, or otherwise introduce inferior terms.

Like LIBOR, LRR is a variable rate, so we‘ll tell you about any changes to LRR and the impact on your monthly payments in the same way we would’ve done for changes to LIBOR.

We’ve replaced LIBOR with a reference rate that is calculated in the same way as LIBOR will be calculated for a limited period after 31 December 2021 and we expect LRR to perform in a similar way to LIBOR so you shouldn’t pay more over the term of your mortgage than you would’ve done had we not moved to LRR to calculate the interest rate you pay.

We’re unable to tell you exactly what the interest rate or monthly mortgage payment will be following the move to LRR until we first recalculate the interest rate you pay using LRR as, like LIBOR, LRR is a variable rate, so it’s likely to change before then.

We’ll write to you before your first payment based on LRR to tell you interest rate that will then apply and how this affects your monthly payment.

The amendments to your mortgage agreement took effect from 1 January 2022, but interest on your mortgage won’t begin to be calculated using LRR until your quarterly interest period ends for the first time in 2022.

Let’s say that your current 3-Month LIBOR linked mortgage has the interest rate set every quarter on the 1 January, April, July and October and is based on LIBOR on the 15th of the preceding month. We’ve shown how this will work below:

Like LIBOR, LRR is a variable rate, so we’ll tell you about any changes to LRR and the impact on your monthly payments in the same way as we would’ve done for changes to LIBOR.

Fixed Rate Products

If you currently pay a fixed rate of interest then your interest rate won’t change until the end of the fixed period. At the end of the fixed rate period the variable interest rate which will apply to your mortgage will be based on LRR rather than LIBOR unless the fixed rate period ends before 31 March 2022, in which case the variable rate may initially be based on LIBOR until the first quarterly scheduled interest rate reset date after 1 January 2022.

No. You’ll continue to receive all communications as normal, the only change you’ll notice is these communications will refer to LRR instead of LIBOR.

When we refer to LRR in future communications this is calculated as explained fully in the Appendix 1 to the letter we sent telling you about this change.

You may receive some communications referencing LRR prior to your interest rate being recalculated using LRR for the reasons explained in question 12 above.

If you’re looking for more detailed information about LIBOR; the following links from industry bodies and organisations may be useful: